- This event has passed.

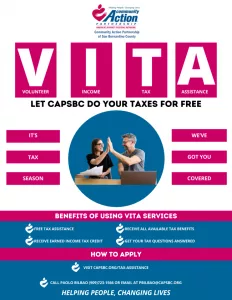

Let CAPSBC Do Your Taxes for Free

March 13 @ 8:00 am - April 14 @ 5:00 pm

Volunteer Income Tax Assistance (VITA)

Schedule your 2025 tax assistance appointment now!

Our Volunteer Income Tax Assistance (VITA) helps eligible low-income families file their taxes for free and ensure they receive all eligible tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), Young Child Tax Credit (YCTC), and the American Opportunity Tax Credit (AOTC).

Prepare my tax return

Make an appointment to drop off your taxes through the buttons below

Eligibility requirements

Clients with any of the following, qualify for assistance

-

A combined household income below $67,000 per year

-

Retirees 60 years of age and older

-

Persons with disabilities

-

Limited English-speaking taxpayers

What to expect at my tax appointment

-

You will need to provide copies of your identification and tax forms. We do not keep originals

-

Drop off copies of identification and tax forms during your scheduled appointment time

-

Upon arrival, forms 13614-C and 14446 must be completed

-

Your taxes will be prepared for your return and within a week, you’ll be contacted to schedule a follow-up review

-

For more information on how to be prepared for your tax appointment, tap the button below

BECOME A VOLUNTEER TAX PREPARER

VITA volunteers are IRS-certified to help families prepare their taxes and help ensure they receive all eligible tax credits, such as the Earned Income Tax Credit (EITC) and the Young Child Tax Credit (YCTC).

Step 1) Interested in volunteering? – Take advantage of the Franchise Tax Board’s Free VITA training videos below. Be sure to also review the Intake Interview and Quality Review training and the Volunteer Standards of conduct

Step 2) Get Certified! – Secondly, CAPSBC VITA Volunteers must pass all required tests and be certified at the Advanced Level. Volunteers can get certified through the IRS’s Link and Learn Certification.

Step 3) Schedule a Volunteer Shift – Once you receive the Advanced Level Certification, you may sign up to volunteer with CAPSBC’s VITA Program. Check out our volunteer booking page for available shifts and to schedule yourself!

Earn Income Tax Credit (EITC)

The EITC is a tax benefit for low to moderate income working people, which provides credit that offset any taxes owed and can provide a refund even if no taxes are owed. Workers must file a tax return to take advantage. To see how much you may get back, click here. For more information on CalEITC, please visit www.myfreetaxes.com or www.caleitc4me.org.